Development Costs, Interest Rates, and the Future

There are a lot of headlines about coming interest rate cuts and their effect on the economy, on real estate and construction, and on housing. With costs for financing turning lower and the assumption that these costs are a key limiting factor, the story goes that the spigot of new development will reopen.

Yet while borrowing costs may improve, new projects are still likely to be challenging, and communities that accustom to the new operating environment and put energy into pulling together their futures will benefit. Let’s examine.

Stakeholders have been looking forward to a so-called soft landing. And, recent financial market turmoil not withstanding, it appears still that this is a possibility as the economy seems to be cooling by a variety of factors, including job openings and housing starts, and more foreclosures at the edges of the commercial real estate market.

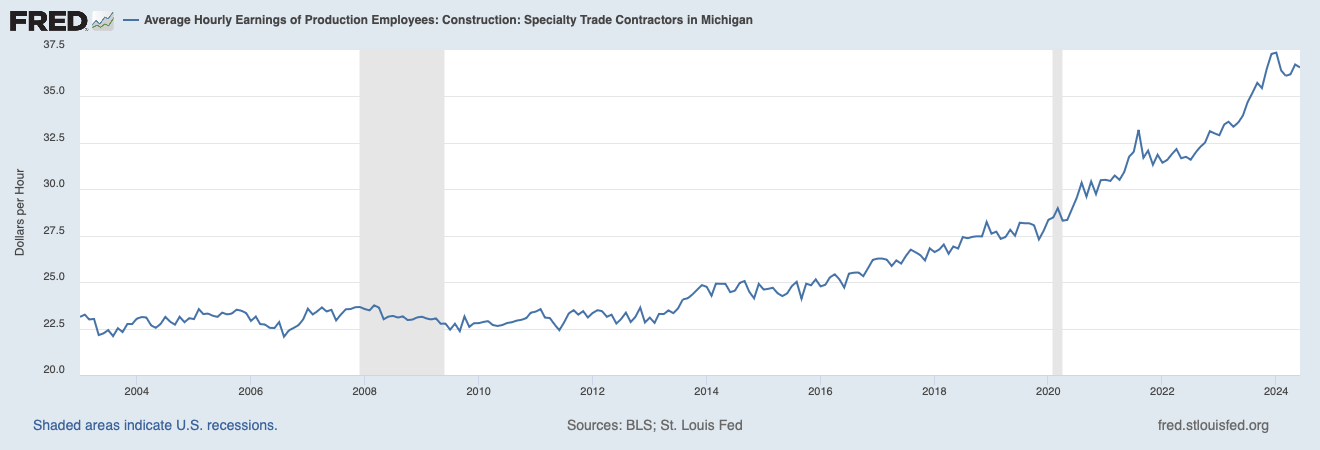

Rise in specialty trade contractor earnings. U.S. Bureau of Labor Statistics and Federal Reserve Bank of St. Louis, Average Hourly Earnings of Production Employees: Construction: Specialty Trade Contractors in Michigan [SMU26000002023800008], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SMU26000002023800008, August 6, 2024.

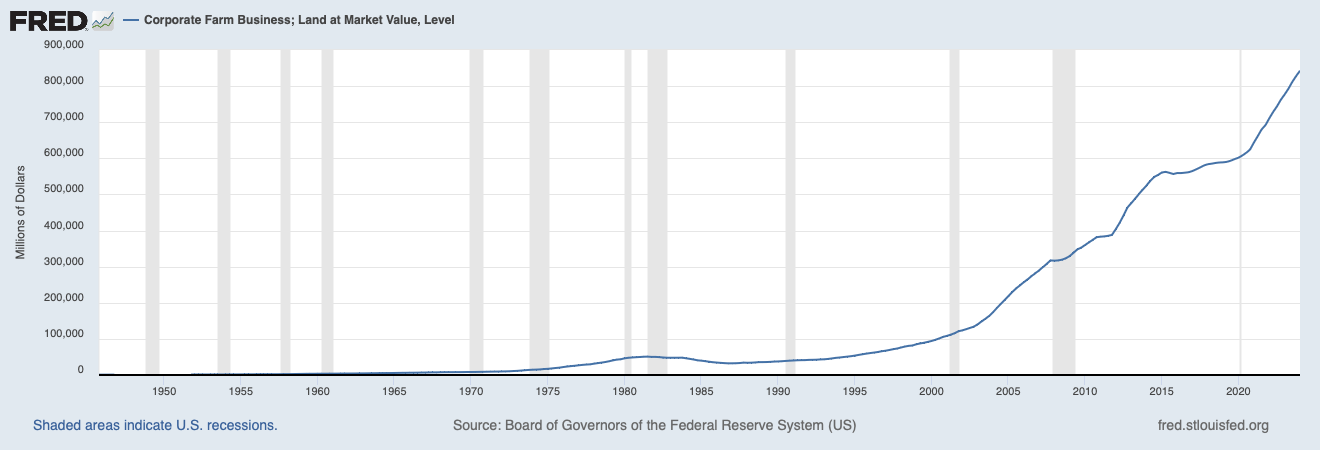

Though a soft landing means reduction in short term rates and limited reduction in housing-important longer term rates without a lot of pain, it’s not just a ride off into the sunset. Given stickier higher wages, land and construction costs, even with higher comps many projects aren’t going to be as attractive to build such as they were before the pandemic. And there are very good things about, for example, trades and construction workers receiving better pay.

Land at Market Value. Board of Governors of the Federal Reserve System (US), Corporate Farm Business; Land at Market Value, Level [BOGZ1FL185010005Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL185010005Q, August 6, 2024.

Yet expensive new construction is at odds with low valuations in the public REIT markets (though in the past couple weeks those have started to trend up, see Mid America Apartment Communities REIT) and the news heralding the end of commercial real estate. Although there are some problem subsections like non-prime office, the generalization of problems to all of commercial real estate is a missed opportunity for clarity.

Large private equity investors have seen that existing assets are valuable and difficult to replicate, and are brushing by the hand wringing about “commercial real estate.” They are not waiting for interest rates to fall, they know that there is a structural need for real estate from housing to energy generation to data centers to even cold storage (see examples in housing of the Blackstone acquisition of both Tricon Residential, a single family residential REIT, Apartment Income REIT, a multifamily residential REIT, and recent IPO of Lineage, a cold storage REIT). Some investors are leveraging their balance sheets to raise funds, acquiring large private portfolios that are not moving on the private market (See Triple Net Lease operator Realty Income REIT). They are also disposing of properties on the private market and getting more than their public valuation would imply (such as Global Net Lease REIT). Positive operating results across a broad swath of REIT publicly-listed results underscores the market demand continues.

Paying attention to the systemic moves is a good source of information on what may happen. Community leaders may want to consider that project prospects are likely to be continually pressured on costs. The math shows a new normal, with continued demand for housing and amenities, quality retail around them, and other supporting infrastructure.

If communities want to attract workers with amenities and homes a workforce can afford, it’s like the tree planting: The best time was 20 years ago, but the next best time to get organized and move forward is right now.