Economics and Interest Rates, Mid 2025

Historical interest rates and the projections (which keep changing)

Occasionally, I like to post about the real estate and finance side of community development. I work with many kinds of organizations, and I enjoy delving into community development because it incorporates economics, investing, and physical spaces—the ones that can make us feel at home, or not.

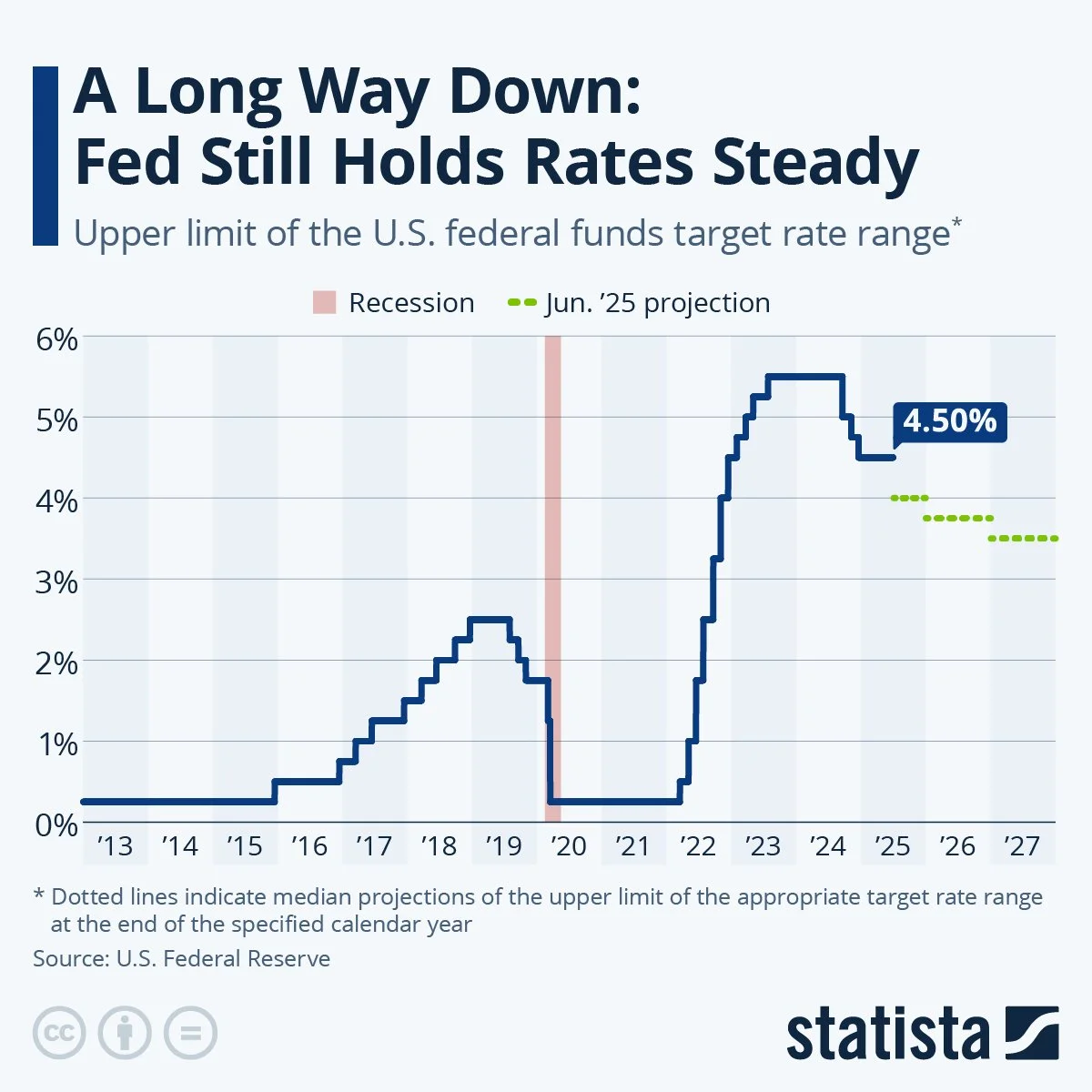

Last summer, I wrote about interest rates and how communities and leaders were not waiting to invest until rates go down. And that action-oriented way of being was good thinking by these leaders, because those rates have stayed stubbornly higher for longer than many would like.

It’s tempting to wish that the rates will return to those much lower rates that made all project financing easier. However, those post-pandemic (and most great financial crisis) rates were historically low. The current short-term interest rates are only about a percentage point above the neutral interest rate level. Given the expectations of inflation from tariffs, oil and fossil energy prices in the medium term, we could still easily see months of similar interest rates.

At the same time, despite these still meaningfully-elevated rates, real estate experts are seeing the markets start to thaw with time. Demand eventually starts to gather, and with new building starts from apartments to commercial to pretty much anything but data centers on pause for the last couple of years, it is natural to expect the market to slowly unfreeze into a new reality with the higher rates still present. That doesn’t mean that rates will not come down a little bit over the next year which can juice the already thawing market as discussed below.

On the housing side, higher interest rates have brought back more inventory by slowing demand so that the natural life rhythms as people list their homes has accelerated. But, as many are familiar from their own neighborhood, these homes are staying on the market longer and the percentage that are undergoing price cuts has increased substantially. That is a healthy thing because the listing prices have continued to be very high, even in the context of higher interest rates, which affects affordability.

The economic realities with a potentially slowing labor market or the always-possible recession could change our interest rate trajectory. Yet the labor market has continued to show strength, with strong employment numbers coming in before the July holiday weekend. That means that the interest rates we have may stay around for a while. Eventually, within the year, given how the new administration is operating, I do expect some decline in the interest rates with a new Federal Reserve Board of Governors Chair. Yet it is useful to remember that interest rates are set by a committee, so a new chair does not automatically lower rates either.

What does this environment mean for community development leaders?

For community development leaders, halfway through 2025 the thinking should still be the same as I wrote last year: don’t wait for vastly lower rates, and instead, make prudent decisions about investments given our current reality and operating environment. Just like timing the financial markets generally is not a good strategy in general, we’ve seen how waiting for interest rate changes is not the most productive way of thinking about development decisions.

One option to consider is to be creative with private sector partners to help fund developments. Although federal investments in community development are under pressure currently, these will stabilize in the coming year under the current political reality. It will become likely more important to think about partnering with private entities—so long as the community development organization can protect itself and its public interest mission in negotiation with a profit-driven entity.

Finally, I am holding the victims and survivors of the Texas Hill Country floods and the Central North Carolina floods in my thoughts. As a Texas native who was back in my birth state earlier this year, I wish we had done better and been more cautious there. And to my NC neighbors who have also experienced loss as the tropical storm brought unexpectedly concentrated rains, I am thinking of you and will be volunteering with the recovery and clean-up efforts.